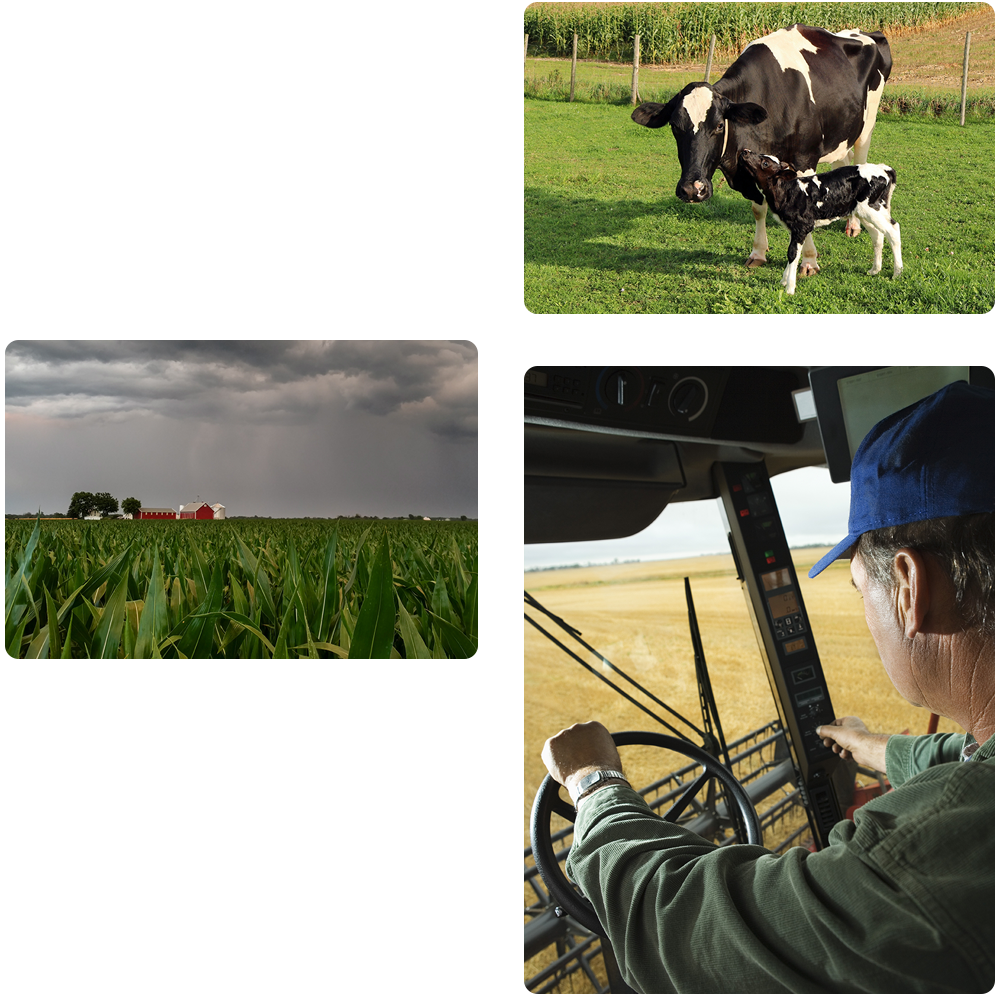

Farm Umbrella insurance

Safeguard your farm against unexpected accidents or incident claims with an extra layer of coverage.

Farm Umbrella insurance helps safeguard against a challenging profession that comes with many risks and uncertainties.

Farm Umbrella Liability insurance provides additional coverage beyond what is provided by standard farm insurance policy to protect against these risks. It can help protect from the financial impact of a liability claim, allowing you to focus on running your farm without worrying about the financial consequences of a liability claim.

Features of Farm Umbrella insurance

SECURA Farm Umbrella liability policyholders have access to the following features that help reduce costs and streamline care.

High limits

Our Farm Umbrella Liability policy provides additional limits above and beyond that of your underlying insurance, including:

- Automobile Liability

- Farmers’ Comprehensive Personal Liability (Farm Liability)

- Personal and Advertising Injury Liability

- Watercraft and Recreation Vehicle Liability

- Incidental Business or Office Liability

- Employer’s Liability

- Contractual Liability

Policyholder benefits that work

Risk management services

Exceptional claims experience

Independent local agents

Commonly asked questions about farm umbrella insurance

What is Farm Umbrella insurance?

As a farmer, you have all sorts of risks and liabilities that come with running a farm – from equipment accidents to potential lawsuits from visitors. That’s where Farm Umbrella insurance comes in handy. It provides an extra layer of liability coverage that goes beyond what your other farm insurance policies cover. So, if you find yourself facing a large claim or lawsuit, your farm umbrella insurance can help cover the costs that exceed your other policy limits. It’s like having an extra safety net to protect your farm and your livelihood.

How does Farm Umbrella insurance work?

Umbrella insurance is like an extra layer of protection that sits on top of your existing insurance policies. It provides additional liability coverage in case you are sued for damages that exceed the limits of your other insurance policies.

What does Farm Umbrella insurance cover?

It’s designed to kick in when the liability limits of the underlying policies have been exhausted due to a major claim or lawsuit.

So, in essence, Farm Umbrella insurance can cover a variety of liabilities that aren’t covered by a typical farm insurance policy, such as lawsuits, medical expenses, property damage, and more. It can be a great way to safeguard your farm against unexpected events that could potentially drain your financial resources.

It’s important to note that Farm Umbrella insurance doesn’t cover everything. It’s typically meant to cover liability claims related to bodily injury or property damage, and it usually doesn’t cover intentional acts or criminal behavior.

Why SECURA?

SECURA offers farm coverages in eight states, and we are proud to support the communities that have welcomed us for more than a century.