Small business insurance

You have spent a lot of time building your small business. Make sure it’s protected with the right insurance coverages from SECURA.

Your small business is a big deal.

Having the right small business insurance can help cover costs related to property damage, injuries, employee mistakes, and even cyberattacks.

What insurance coverages do small businesses need?

Commercial Auto

Cyber Security

Employment Practices Liability Insurance (EPLI)

Errors and Omissions

General Liability

Inland Marine

Workers’ Compensation

Commercial Umbrella

Professional Liability

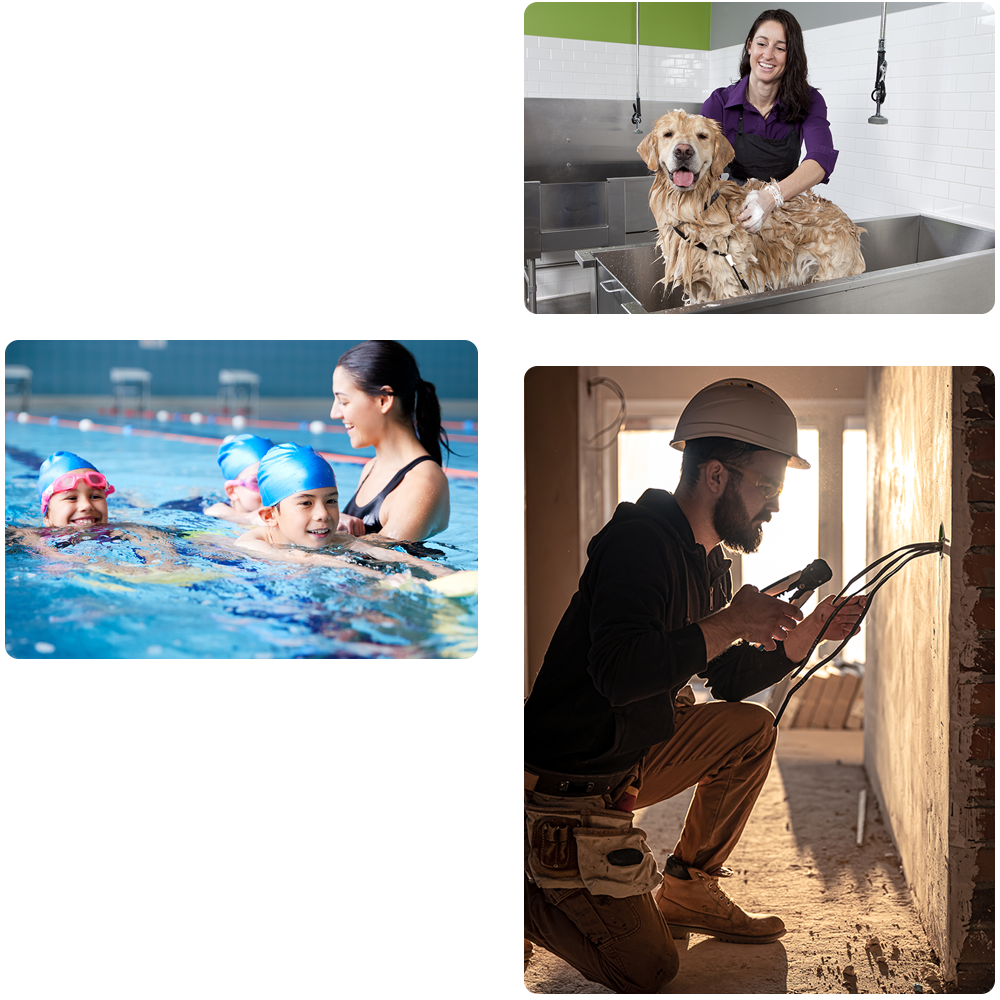

SECURA provides insurance for small business owners within many types of industries

Don’t see your industry listed? Have a conversation with your local agent to learn more about how SECURA Insurance is right for your business.

- Accounting, auditing, and bookkeeping services

- Beauty businesses

- Events

- Health and fitness clubs

- Hunting and fishing guides

- Insurance agents and brokers

- Legal services

- Management consulting services

- Medical offices

- Pet groomers, sitters, walkers, and trainers

- Retail

- Swimming schools, clubs, and leagues

- Trade contractors

- Sports and recreation clubs

Policyholder benefits that work

Risk Management

Exceptional claims service

Independent local agents

Helpful articles

Why SECURA?

SECURA operates in 13 states with a variety of business insurance solutions, and we are proud to support the communities that have welcomed us for more than a century.